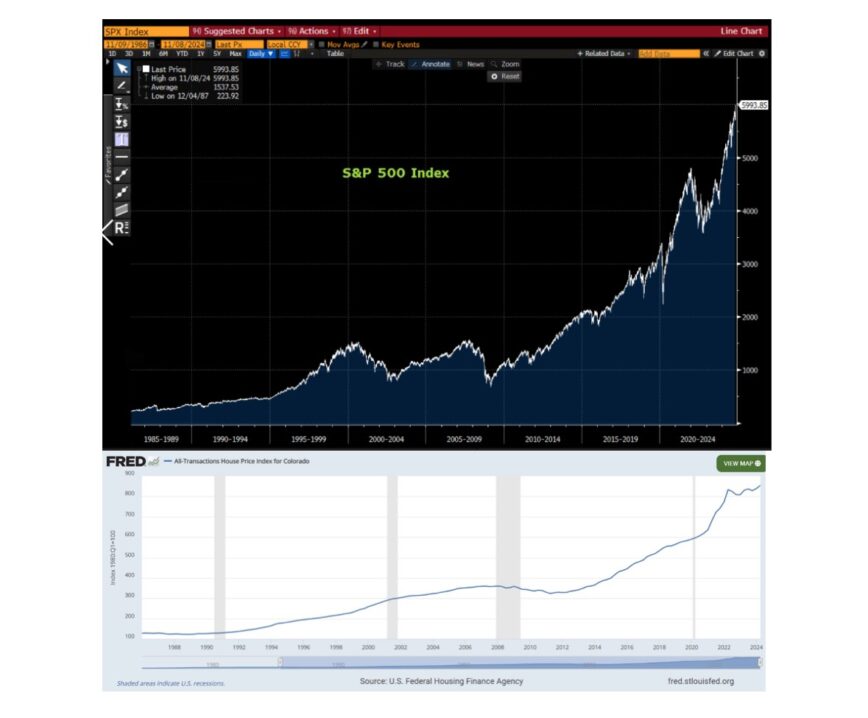

What if I told you that one of history’s greatest bull markets in financial assets and real estate unfolded while we, midlife males, were growing up and grinding it out over the past 30 to 40 years? I use this measurement period because I didn’t start accumulating capital until the 1980s, when I bought my first stock, and real estate in the ’90s. Take a closer look at the two charts below on the S&P 500 and Colorado real estate prices to gain some perspective.

Anyone invested in these asset classes over the past 40 years has made money. Those who used leverage made a killing. Simply put, stocks have provided 35x returns (dividends reinvested), and real estate has yielded 8x returns. For the math nerds, that’s 3,500% and 800%, respectively. These are general market returns and don’t account for incredible individual stock picks (like AAPL, MSFT, NVDA, TSLA, etc.) or buying real estate in Aspen instead of Denver. Those choices could’ve added an extra digit to your net worth.

In hindsight, this looks like a generational opportunity to create family wealth. If we were lucky enough to be born in the ’60s or ’70s, we can thank declining interest rates, the sixth wave of innovation, deficit spending, and functional capital markets for much of this growth. But let’s take a deep breath and ask ourselves: What the F do we do now? How much risk should we take in the next decade of our financial lives?

A former fintech executive and close friend of mine has the word “Enough” tattooed on his leg as a daily reminder that he doesn’t need to grind and chase money anymore—doing so would come at the expense of his health and relationships. One of my most influential mentors, a hidden titan among America’s wealthiest entrepreneurs, made it clear after reaching a financial milestone that he was done.

“Let the boys know I don’t do deals anymore,” he told his inner circle. He doesn’t want phone calls, capital calls, fake friends, or meetings that don’t involve a horse or a fly-fishing stream. He reduced his risk profile, shifted to less equity and more bonds, and now lives comfortably off his income.

For those lucky enough to have participated fully in the historic rise of asset values and found liquidity events along the way, it makes sense to reduce risk, diversify, and protect the lifestyle wealth has afforded. Our lives could drastically change if we kept the pedal to the metal, lost everything, and had to start over again in one-bedroom apartments with nothing but a big idea and a burning desire. The saying goes, “You only need to get rich once.”

The real work begins in protecting wealth, passing it on thoughtfully without spoiling our children, and staying grounded to avoid becoming overconfident jerks.

But what if we don’t have “enough” or aren’t where we want to be financially? How much risk should we take now? First, give history its due and recognize that while the trend has been upward, there have been painful pullbacks along the way. The 30% decline in the S&P 500 during the COVID crisis, the 25% correction in real estate during the Great Financial Crisis of 2008–2010, and the 75% NASDAQ bubble burst in 2000 come to mind. Even Bitcoin’s 75% decline in 2022, though brutal, has now more than fully recovered. Every decade brings its minor and major pullbacks.

In my 40 years as an investor, I’ve seen them all—and I regret not being more aggressive every time they happened. Despite the historic upward trend, there will always be new opportunities to deploy fresh capital if you stay in the game and prepare to act. Many people claim they’ll buy the next pullback, but few actually do. The 36-minute, 9% drop during the “Flash Crash” of May 6, 2010, is one of many episodes of volatility that provided entry points into a long-term bull market. For example, anyone who bought NVIDIA after its 30% pullback in August this year would now be up 47%. As Jim Cramer says, “There’s always a bull market somewhere.”

Being educated about history and consistently learning more about your favorite asset class will prepare you to “make a move that makes a difference.” For those of us not there yet, it’s time to prepare to seize significant opportunities and learn to take on more risk.

As Max Gunther wrote in The Zurich Axioms, “If you aren’t nervous, you aren’t taking enough risk.” Ask those with “enough” how they made it, and they’ll likely point to just a few key decisions in their lifetime.

We need to recognize that in our financial journey, we’ll only have a handful of truly “life-changing” opportunities. Preparing the right mindset is critical to pulling the trigger when the time comes. As Don Henley sang in the famous Eagles song:

“I have hurried a lot, I have worried a lot.

Who can go the distance?

Who can handle some resistance?

We’ll find out in the long run.”

—

Interested in receiving more FREE articles like this? Subscribe to the Midlife Male Newsletter here.

Ron Speaker is a Wall Street veteran with over 38 years of professional experience in the markets. He began his career as a summer intern in 1986 at Janus Capital Group during the company’s meteoric rise in the mutual fund industry working for two finance legends, Tom Bailey and Michael McGoldrick.

During his 21-year career at Janus, he had a front row seat to the major market moving events from the stock market crash of 1987, the credit and Latin American debt crisis of the early 1990’s, the Long-Term Capital bond market blow up, the 1997 Asian crisis, the Dot-Com bubble, the tragedy of 9/11, the Iraq war of 2003, the 2010 flash crash, and the 2008 great financial and housing crisis.

After leaving Janus Ron started his own investment firm, Equus Private Wealth, a boutique fixed income firm that focused on municipal bonds for high-net-worth investors. Equus became known as the authority on Colorado municipal bonds and a specialist at non-rated, higher yielding issues. He and his team developed financial models and boots on the ground research methods that were unique for municipal bond investors. During this period of his career, he successfully navigated the markets during the 2010-2012 housing recession, the 2020 Covid crisis and the 2022 rise in interest rates that delivered the worst bond market performance in over 40 years.

With his vast working experience and knowledge passed down from his mentors, Ron is now focusing on sharing his experience and wisdom through “The Finance Camp” for teens beginning in the summer of 2023.